“May Be Running A Ponzi Scheme”: Even After Explicit Warning from Another Bank, Berkshire Gave Unlicensed Fraudster a Personal Check Scanner to Remotely Deposit $300,000 a Day.

SYRACUSE – SEPTEMBER 10, 2025 – Hundreds of investor-victims filed a major class action lawsuit against Berkshire Bank over its role in aiding and abetting Miles Burton Marshall, the Upstate New York fraudster charged with running a $100 million Ponzi scheme. Many of the nearly 1,000 investors who were defrauded by Marshall lost their life savings.

The lawsuit was filed jointly by a putative class of investor-victims and by Fred Stevens, the Plan Administrator and Assignee of Bank Litigation Claims from 369 investor-victims with the United States District Court for the Northern District of New York. The class of investor-victims are represented by Jason Kane and Daniel Centner of the law firm Peiffer Wolf Carr Kane Conway & Wise (Peiffer Wolf) and Scott Silver, Peter Spett, and Ryan Schwamm of Silver Law Group. Fred Stevens is represented by Robert Elgidely, Catherine Youngman, and Joseph DiPasquale of Fox Rothschild LLP.

Darlene Stetson, an investor-victim from Waterville, New York, said: “It was one of the biggest shocks of our lives when this house of cards came crashing down. The money that was stolen has financially crippled many families and organizations within the community. The more we learn about how Berkshire Bank allegedly enabled this fraudulent activity and blatantly ignored its legal duties as a bank, the more we feel utterly outraged. Berkshire Bank must be held accountable.”

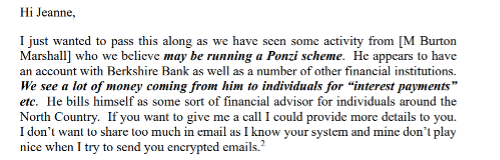

Daniel Centner, partner at Peiffer Wolf, said: “As our lawsuit details, Marshall’s scheme was so apparent that another bank even reached out to Berkshire Bank’s assistant vice president of security and fraud investigations and warned that they believed Marshall may be running a Ponzi scheme. Berkshire Bank not only ignored that warning, it doubled-down on its support for Marshall by giving him a personal check scanner that allowed him to remotely deposit up to $300,000 … a day.”

Robert Elgidely, partner, Fox Rothschild, said: “An investment scheme of this scale and magnitude simply cannot be undertaken by one person alone. In this case, we allege that Berkshire Bank was not only turning a blind eye to obvious criminal activity – they were enabling it and profiting from it at every step of the way.”

Fred Stevens, Plan Administrator & Assignee of Bank Litigation Claims, said: “Given the corporate merger between Berkshire Bank and Brookline Bancorp happening at the same time as the threat of this lawsuit, it raises a whole lot of questions. Were the hundreds of millions in Ponzi transactions instrumental in making Berkshire a more attractive acquisition target? Are the banks rebranding as Beacon Financial Corporation to try to sweep this disaster under the rug? And how much did Brookline know about Berkshire’s failures, and when?”

According to the lawsuit, Berkshire Bank had knowledge of Marshall’s misconduct, and at least one prior bank had terminated its relationship with Marshall based on his patterns of activity. That same bank even explicitly warned Berkshire Bank in 2021 that they believed Marshall was running a Ponzi scheme. The complaint details how Berkshire Bank chose to retain Marshall as a significant deposit account customer instead of closing his accounts and reporting him to law enforcement authorities as was required by federal law and the bank’s own policies and procedures.

Each of the 49 counts included in the indictment issued by a grand jury at the request of the New York State Attorney General occurred during the time Marshall banked exclusively with Berkshire Bank. Those charges included securities fraud, grand larceny and a scheme to defraud in the first degree.

From 2015 through 2023, Marshall maintained an account in his individual name at Berkshire Bank (the “2301” Account) along with six other accounts titled in both his individual name and the name of a “doing business as” sole proprietorship. While Berkshire Bank required Marshall to open separate accounts for each “doing business as” account, the Bank allegedly, and continuously, allowed him to commingle the funds in such accounts by sweeping them from the “doing business as” accounts to the account titled in his individual name, the 2301 Account.

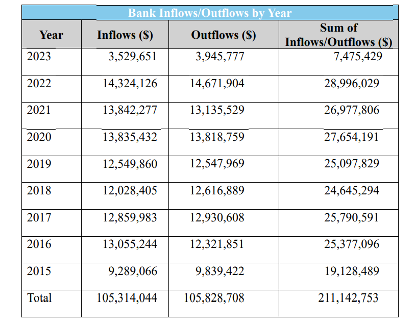

Incredibly, Marshall’s Ponzi scheme ran over $211 million in transactions through his 2301 Account from 2015 through 2023:

Although Berkshire Bank had common law, statutory and regulatory duties to detect and terminate fraudulent, illicit, and potentially criminal banking activities in the Marshall accounts, the lawsuit claims that Berkshire Bank failed to do so.

For instance, the complaint alleges that Berkshire Bank knew that Marshall was actively soliciting investments and funneling the money through his accounts, allowing him to funnel tens of millions of dollars in investment funds through his accounts each year – even though the Bank was aware Marshall was not licensed to sell investments or provide investment advice, and that such activity was wildly inconsistent with his customer profile. The investor-victims allege that Berkshire Bank allowed Marshall to funnel the investment funds through his accounts even though it knew that his liabilities exceeded his assets by tens of millions of dollars at any particular time.

The complaint describes how Marshall’s significant transaction activity triggered consistent Bank Secrecy Act (BSA) and other alerts on Berkshire Bank’s sophisticated account activity monitoring systems over the years – an average of one BSA alert approximately every six weeks, and other alerts an average of once every five weeks.

Marshall’s scheme is alleged to have been so obvious that another bank that Marshall was no longer doing business with sent Berkshire an email warning that Marshall was using his Berkshire Bank accounts to perpetrate a Ponzi scheme. On October 18, 2021, the Senior AML/Fraud Investigator with NBT Bancorp Inc. sent the following email to Berkshire Bank’s AVP, Security & Fraud Investigations:

According to the lawsuit, Marshall did most of his banking at Berkshire Bank’s Oriskany Falls branch, where employees were allegedly aware of Marshall’s activity and consistently willing to look the other way. When Berkshire Bank announced it would be closing that branch in October 2021 (the same month it received the above email from NBT), the investor-victims claim that the Bank was worried it would be losing Marshall as a customer and therefore “tasked a private banker with the responsibility of retaining Marshall as a customer and incentivized Marshall to do so by providing a scanner that enabled him to remotely deposit up to $300,000 in checks per day.”

The lawsuit charges that Berkshire Bank should have shut down Marshall’s accounts or reported him to law enforcement authorities as required by federal law and its policies and procedures, but failed to do so prior to Marshall’s collapse in 2023 purely for business reasons. Cash deposits are the lifeblood of a bank, just like they are the lifeblood of a Ponzi scheme. Banks use customer deposits to make loans to third parties and to invest in various opportunities in order to generate more money for the bank. As customer deposits increase, so too does a bank’s profile as an attractive acquisition target. According to the complaint, Berkshire Bank knowingly pursued its business objective of maximizing assets held, and to generate substantial fees, charges, interest, and other forms of revenue to the exclusion and detriment of Marshall’s noteholder investors.

In August, Berkshire Bank announced a corporate merger with Brookline Bancorp. According to the complaint, the combined holding company created through the merger is being rebranded as Beacon Bank, which will assume full legal responsibility for the failures of Berkshire Bank.

###

MEDIA CONTACT:

Max Karlin at (703) 276-3255 or [email protected].

Peiffer Wolf Carr Kane Conway & Wise is a national law firm with offices in New York, New Orleans, Chicago, San Francisco, Los Angeles, Cleveland, Youngstown, St. Louis and Detroit. Visit https://brokerwatch.com/ for more information.

Silver Law Group is a national securities and investment fraud law firm. Our partners routinely handle class actions and other cases involving Ponzi schemes, investment fraud and financial advisor misconduct. Learn more about us at securitiesfraudattorneys.com.

Fox Rothschild LLP is a national, full-service law firm, having 70 practice areas, 1,000 attorneys, and 30 offices from coast to coast. Visit www.FoxRothschild.com for more information.